Tariff Wars Melt Profits - Unless You Do This

Listen to the audio version here.

When a global tariff war kicks off, companies must urgently rethink their pricing strategy—or risk seeing their profits evaporate.

The big question: How do you do this fast, without massive investment?

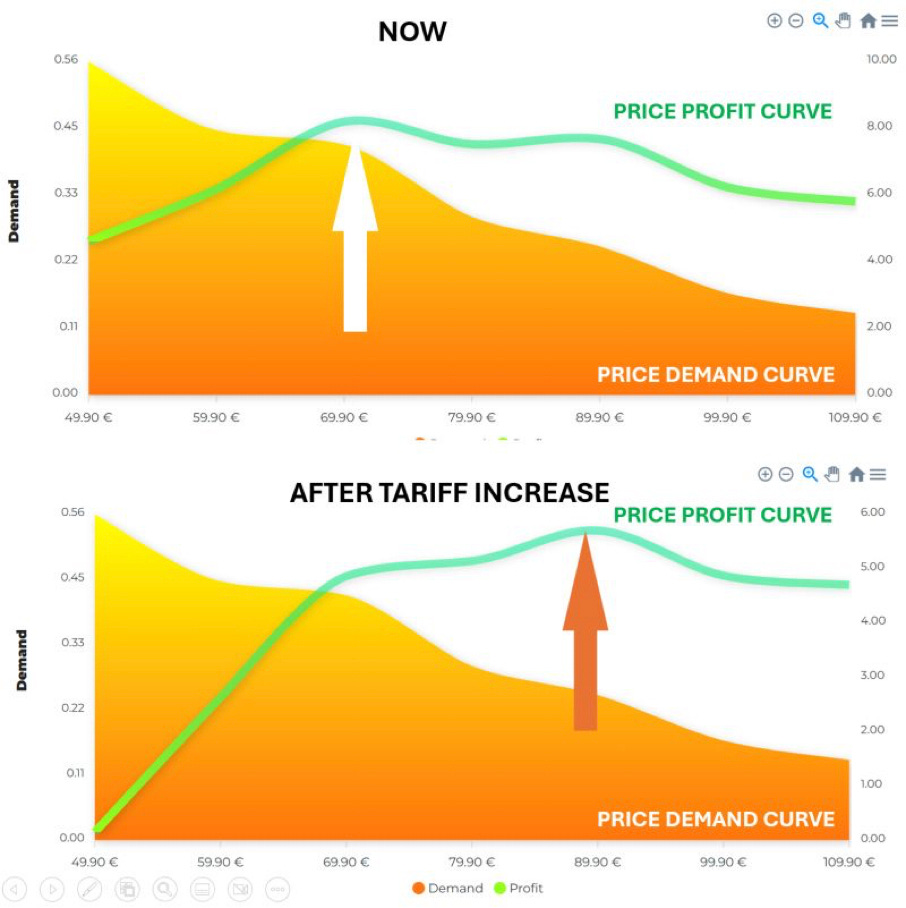

Let’s start with a real-world price-demand curve for a coffee machine. Right now, the optimal price—the one that maximizes profit—is 69 euros.

Why? Because at 69 euros, the margin (which rises with price) multiplied by the volume (which drops as price goes up) hits its sweet spot.

But when raw material costs jump by 30%, the optimal price doesn’t rise in the same amount. It jumps to 89 euros.

Here’s the kicker:

Price increases aren’t proportional.

They depend on the shape of the price-demand curve.

Sometimes, no price increase is optimal at all.

Other times, a 30% cost increase might require a 100% price increase to maintain profitability.

You won’t know until you measure it.

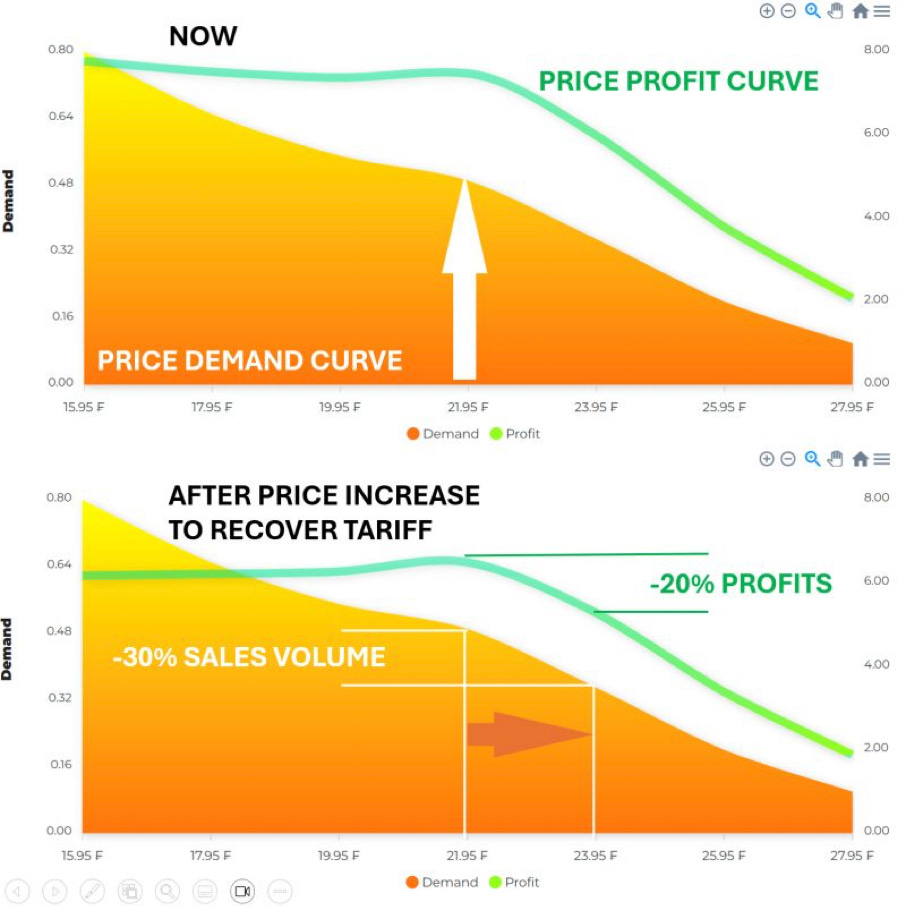

Now, here’s where tariff wars become dangerous: If companies blindly tack the cost increase onto their prices, they could walk straight into a profit massacre.

Check out the orange curve below—it's a real price-demand function for a merchandising product.

As costs go up, many companies instinctively raise prices to compensate.

This works only if the demand curve is flat enough.

If it's steep, demand can plummet faster than your margin grows.

You might think, “If competitors raise prices too, everything balances out.”

But unless you’re selling a true commodity, pricing dynamics are often far more complex.

So, how do you know if a price increase is viable?

You measure the price-demand curve. And here’s how:

Option 1: Analyze market sales data.

Useful—but only shows demand at current prices. It doesn't reveal untapped opportunities.Option 2: Use Van Westendorp or Gabor-Granger.

These can give directional insights but lack depth. For example, Van Westendorp doesn't even account for costs.Option 3: Conjoint analysis.

Sophisticated but expensive and slow, especially for repricing entire product lines. It can also misfire in some pricing scenarios.

Enter a better option: Implicit Price Intelligence.

This new approach gauges emotional pricing signals—how people feel about a price. And research shows it's often more accurate than legacy methods.

Even better:

It's simple, fast, and scalable.

For instance SUPRA.tools enables you to reprice your entire product line in a single week, if needed.

Why We Track Everything—Except the One Thing That Matters Most

We track NPS and satisfaction.

We track brand awareness and ad recall.

We track sales, trends, and competitors.

We track everything that moves...

except Willingness-To-Pay.

If we tracked that, we could:

Boost profits immediately

Detect market changes early (tariffs, trends, competition)

Quantify our brand’s pricing power

Adapt prices dynamically to external shocks

But we don’t. Why?

Is it impossible?

No, it’s not.

Was it too expensive?

Yes—until now.

Implicit Price Intelligence changes the game.

Now, tracking Willingness-To-Pay is valid, cost-effective, and agile.

This is what makes it a game-changer for rapid price re-optimization.

This is what makes it a foundational tool for pricing strategy.

Set up a Willingness-To-Pay tracker as your baseline.

If you're hit by a tariff shock, reassess all core prices in your core markets using Implicit Price Intelligence.

This is how you get 10x insights.

This is how you protect—or even grow—your profits.

This is how you win.